When you invest in diamond jewelry, you want to ensure that your investment is protected. Whether you just got engaged or finally gifted yourself a beautiful pair of gold earrings, keeping your jewelry safe is so important.

The question is, do you have jewelry insurance? Or do you really need it? We’re answering all your questions and giving you all there is to know about jewelry insurance.

We often insure the most expensive items we own, such as our cars or homes. But in many cases, we don’t think about our jewelry? Your jewelry is something that holds more than just sentimental value as it can be a symbol of love or legacy, and these pieces are often irreplaceable. Read on to find all the answers to some of the most common questions about jewelry insurance.

Jewelry insurance is unfortunately an unknown concept to most people, but protecting your jewelry by having insurance is a very smart move.

Jewelry insurance works just like any other insurance. It is an important guarantee that will give you the peace of mind you need in case of any unfortunate event. However, this insurance specifically covers your precious pieces including, diamond necklaces, earrings, engagement rings, or any other valuable jewelry.

Insurance is a form of risk management that protects you from financial repercussions if your jewelry is damaged, stolen, or lost. These policies normally cover all jewelry items submitted for coverage and result in either replacement, repair, or reimbursement of costs.

In terms of coverage, most jewelry insurance policies will cover the full spectrum. When items are stolen, damaged, or lost, your policy takes effect. Most of the time, jewelry insurance is more comprehensive than your regular homeowner’s policy. And while the majority of those do cover jewelry, it tends to be a smaller amount and only if the piece of jewelry is stolen.

Fortunately, anyone can get jewelry insurance at any time for new or existing items. For example, if you and your partner are about to purchase wedding rings, you can insure them from day one.

However, if you’ve built up a collection of diamond jewelry over time and are only thinking about insurance now, don’t worry, the option is available for you too. If this is the case, you will most likely need to show proof of purchase or get a valuation done if you lost those documents.

The same applies to heirloom jewelry pieces. While it would be impossible to truly replace a diamond bracelet that once belonged to your great-grandmother, you can have the item appraised so that a policy can be purchased for it.

Most basic homeowners or renters insurance policies provide some coverage for your valuables such as jewelry. For the most part, it will only cover your jewelry up to a certain amount of dollars.

A standard policy commonly has a coverage limit which is generally around $1,500. This means that your insurance company won’t pay more than this amount as reimbursement if your jewelry is stolen.

It is important to note that selecting a company that specializes in jewelry insurance will most likely give you more comprehensive coverage.

Just like with all types of policies, jewelry insurance costs are based on the value of each item, how often you wear the piece, and the amount of coverage you wish to have. Experts claim that typically between 1 – 3% of the item’s overall value is paid each year. Basically, if your diamond engagement ring costs $10,000, you will end up paying $100 to $300 in annual insurance premiums.

You can avoid paying too much for your jewelry if you know exactly how much it costs. For example, overestimating its value could result in paying more than you need to. Alternatively, if you underestimate it, you might lose out financially in the event of a claim.

It’s also important to note that rates vary depending on where you live. You can get a quick and simple estimate of what you can expect to pay in your state on Jewelers Mutual’s homepage by using their free estimate tool.

From the very moment you say “yes,” and begin rocking your new, dazzling addition on your hand, the thought of getting engagement ring insurance may be the furthest thing from your mind. But as they say, with great rings come great responsibilities. And, fortunately, during such a happy time, jewelry insurance can provide the peace of mind you need for less than you think.

An engagement ring is among one of the most expensive things you will buy or own in your lifetime. So why not insure it?

Engagement rings are also highly susceptible to damage or loss. Think about it, it is typically worn every day which increases the likelihood that it will be lost, damaged, or stolen.

When shopping around for insurance or buying a standalone jewelry insurance policy, it’s important to compare prices to find the best policy for you. Additionally, there are several different things that can easily help keep the cost of your jewelry insurance low.

It may be possible to reduce your premiums if you have security measures such as a burglar alarm and quality locks. Or, you could consider purchasing a safe to keep your jewelry in when not in use.

Even if you don’t show off your stunning jewels, you can never be sure they will be safe at home. In fact, jewelry is one of the most commonly stolen items out of homes.

Although we provide you with an insurance appraisal that you can use to obtain coverage, we do not provide jewelry insurance.

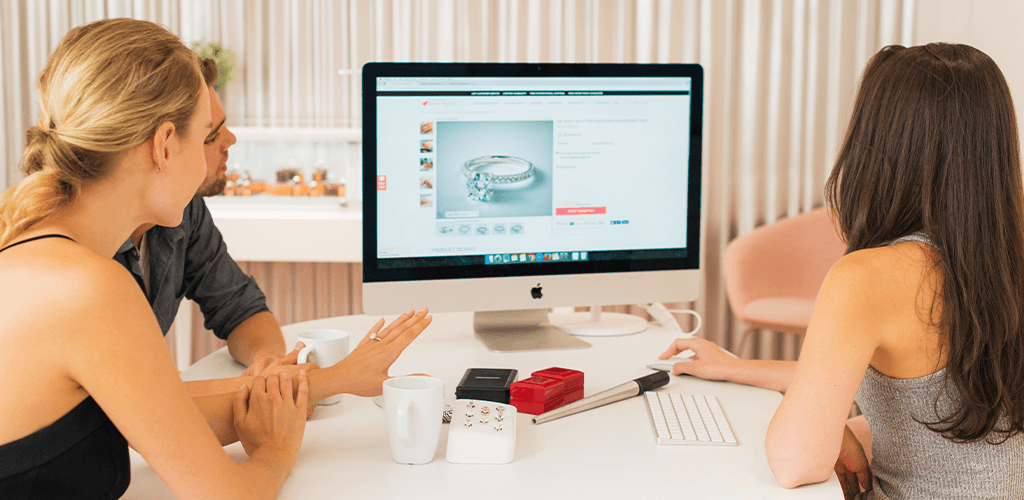

We know that jewelry mishaps are way too common but luckily we at JamesAllen.com have partnered with Jewelers Mutual (JM) Insurance Company. Together we provide you with warranties against damage AND comprehensive jewelry insurance – so you can be protected against wear-and-tear, loss, theft, or extensive damage.

Insuring your jewelry with Jewelers Mutual® Jewelry Insurance is quick and easy, and leaves you with a feeling of emotional and financial security. Learn more and get your free quote today.

Jewelers Mutual® Jewelry Insurance Advantages:

Being adequately informed is super important when deciding which insurance option or provider is best suited to your needs. Here are some great questions to ask while researching diamond jewelry insurance policies:

Yes. Every finished engagement ring or piece of fine jewelry valued at $1,000 or higher will be accompanied by a full insurance evaluation.

We have collaborated with the Jewelers Mutual (JM) Group to provide an upgraded 3-year or lifetime protection plan that protects your jewelry against even more of life’s surprises. You can purchase either one of these plans during checkout or at any time afterward. Click here to see what’s covered and learn how to upgrade your warranty.

Generally, it differs between insurance policies, but rings (including wedding and engagement rings), earrings, bracelets, necklaces, loose diamonds, and watches are typically covered by jewelry insurance. We recommend looking for an insurance company that provides the exact coverage you need.